How do Virginia Employers determine their SUI tax rate?

The Virginia State Unemployment Insurance (SUI) tax rate varies from employer to employer. It can range from a minimum of 0.1% all the way to a maximum of 6.2%. This tax is paid for by the employer on the first $8,000 of wages per employee. Why does this tax rate range? The Virginia State Unemployment… Continue reading How do Virginia Employers determine their SUI tax rate?

What is the current payroll tax rate for employers in Richmond, VA?

The payroll tax rate for 2025 consists of federal payroll taxes, state unemployment taxes, and state withholdings. These taxes, specifically the Social Security and Medicare taxes (FICA taxes), are split between the employer and the employee. The employer withholds the FICA taxes from the employee wages. However, they must pay a matching amount for each… Continue reading What is the current payroll tax rate for employers in Richmond, VA?

How can small Virginia employers stay compliant under the VA Tax?

Well first, what is a withholding tax under Virginia Tax Law? The withholding tax is a state income tax. Employers must deduct it from the wages of employees and remit it to Virginia’s Department of Taxation (VDOT). The goal of this tax is to cover the employees’ personal income tax liabilities. What are the rules… Continue reading How can small Virginia employers stay compliant under the VA Tax?

How can Virginia employers stay compliant with unemployment taxes?

What are Unemployment Taxes? The Virginia Unemployment Compensation Act established Virginia’s State Unemployment Insurance (SUI). And you can think of it like insurance, we pool our resources together to protect ourselves when unemployment hits. Employers must contribute to the state unemployment fund as mandated by the Virginia Employment Commission (VEC). This tax is levied on… Continue reading How can Virginia employers stay compliant with unemployment taxes?

What is the Federal Unemployment Tax Act (FUTA)??

What is the Federal Unemployment Tax Act (FUTA)? FUTA is a federal law that requires employers to pay a payroll tax. This tax funds the federal government’s oversight and funding of unemployment insurance programs. What is Virginia’s State Unemployment Tax Act (SUTA)? This act requires employers in Virginia to pay into Virginia’s State Unemployment Insurance… Continue reading What is the Federal Unemployment Tax Act (FUTA)??

Encourage Employees to Check Their Pay Stubs for Taxes!

As an employer or HR professional, did you field a lot of questions from your employees this past tax season about their withholdings? You’re not alone! Tax time can bring unexpected financial stress if the right amount of taxes hasn’t been taken out throughout the year. But here’s the good news: you and your employees… Continue reading Encourage Employees to Check Their Pay Stubs for Taxes!

Navigating New Hire Paperwork

Hiring new employees is exciting, but it also comes with a plenty of paperwork. Staying compliant with all the federal and state regulations can feel overwhelming. This blog post aims to demystify the process and guide you through the essential legal requirements for navigating new hire paperwork in the US. Key Forms and Deadlines: Form… Continue reading Navigating New Hire Paperwork

Demystifying the W-2: A Clear and Concise Guide for Employees

Ah, the W-2. That mysterious, seemingly hieroglyphic document that arrives each January, leaving many of us scratching our heads and muttering, “What does it all mean?” Fear not, fellow wage earners! This W-2 guide for employees is here to shed light on its secrets, transforming it from a cryptic puzzle into a straightforward summary of… Continue reading Demystifying the W-2: A Clear and Concise Guide for Employees

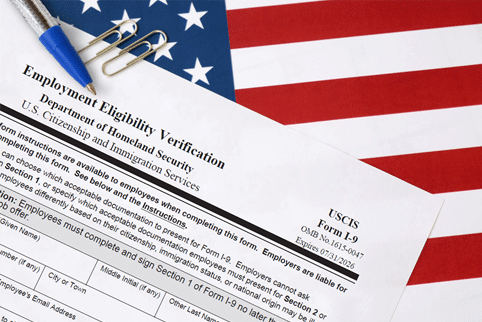

New I-9 Rules for 2024: Everything Employers Need to Know

The Internal Revenue Service (IRS) has released a new version of Form I-9, Employment Eligibility Verification, which will be required for all new hires starting in 2024. The new form includes some important changes that employers need to be aware of. Review the new I-9 rules for 2024 below. New E-Verify Checkbox The new Form… Continue reading New I-9 Rules for 2024: Everything Employers Need to Know

Employee Tax Withholding: Advice for Employers

Tax season is here, and it’s likely that at least one of your employees is asking you why their refund was so big this year, or worse… why they owe so much money. You’re not a tax professional so if you don’t know the answer, that’s normal! However, we’re here to give you some quick… Continue reading Employee Tax Withholding: Advice for Employers